Dallas’ most vulnerable neighborhoods continue to be impacted by gentrification and housing/commercial development. In rapidly gentrifying neighborhoods like West Dallas, the surge in property taxes, up by 1,200% in under a decade, poses severe financial burdens on low-income homeowners. Wesley-Rankin is working to support West Dallas residents with their homestead, property taxes, and heirship issues.

Partners

With decades of experience in property tax appeals, Toby and Will Toler have a strong foundation of experience in appeals for both real estate and business personal property. The Tolers represent clients as Licensed Property Tax Consultants.

![BOH_HorizontalLogo[50] BOH_HorizontalLogo[50]](https://wesleyrankin.org/wp-content/uploads/2024/06/BOH_HorizontalLogo50-scaled.jpg)

Our Approach

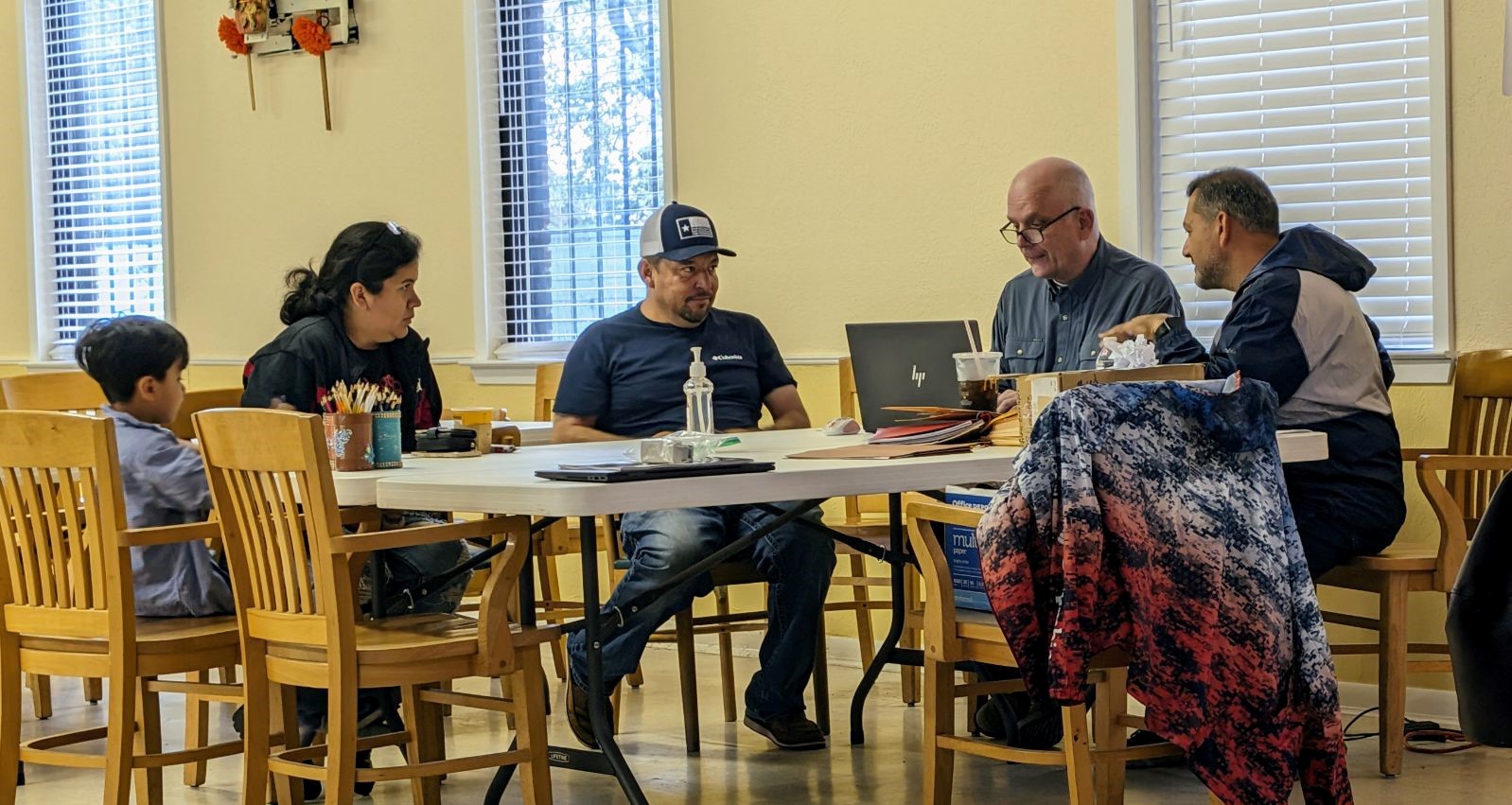

Our unique approach combines Wesley-Rankin’s longstanding social capital and experience in West Dallas with the industry expertise of the Toler Company to provide services to Dallas residents that are holistic, meaningful, and individualized. Our services will always be:

- Bilingual: We will always provide English and Spanish-speaking staff.

- Confidential: All information will be kept private, and we will always practice transparency.

- People-First: All neighbors are treated with respect, receive clear communication, and become informed decision-makers. We are listeners and learners, here to support neighbors’ unique needs with individualized solutions.

- Professional, Organized, & Efficient: We strive to implement effective systems, minimize wait times, and ensure a welcoming environment for all.

What We Offer

Educational Workshops

Educational Workshops on crucial topics for homeowners and renters – launching a new calendar of offerings Fall 2024 stay tuned!!

Property Value & Tax Appeals

Our team will help residents file property value and tax appeals. Homeowners should bring: 1) Dallas Central Appraisal District (DCAD) Value Notice (sent by mail in April) 2) Photos of kitchen, bathrooms, exterior front and back, and any damage.

Homestead Applications

Our team will help residents apply for Homestead Exemption which lowers property for those who qualify. Homeowners and heirs qualify if they live in a home and have a Texas ID or driver's license.

Heirship & Inheritance

Our team will ensure that heirs receive the full benefits of home ownership in accordance with Texas law. Welsey-Rankin will offer resources and solutions to complete the heirship claim process.

Tax Relief Funds

Wesley-Rankin is excited to partner with Builders of Hope in launching a pilot phase of their Property Tax Assistance Program (“PTAP”) designed to provide immediate relief for legacy West Dallas residents who are experiencing the pressure of gentrification and are at risk of displacement due to increasing property tax liability.

This program will pay year over year incremental increases in property taxes for select homeowners who

qualify. The pilot phase has $150,000 of tax relief with a goal to raise a total of $1 million for this program. Applications are open now.

Make an Appointment

Contact Johana Miranda, Housing Services Coordinator, at Johana@wesleyrankin.org or 214-742-6674 ext. 113 to schedule an appointment.